December 2012 Newsletter Vol. 17, No. 1

The Economy

The Economy is still the number one concern of most Americans and small businesses. California is lagging the rest of the Nation, partly because California has more public debt, more unfunded public pensions, more business regulations, more taxes (especially since the passage of Proposition 30), and less exploitation of oil and natural gas than some of the more robust performing states.

Inflation/Deflation

My earlier warnings about inflation being the result of the Federal Reserve pumping money in the system continue to come true. The Fed not only manipulates short term rates, but also manipulates long term rates and mortgage rates. The Fed has surpassed China in the purchase of Treasury notes as the Fed bought 61% of Federal debt last year. The official cost-of-living indices deliberately do not reflect certain important necessities of life such as energy and food. A good indicator of inflation is the value of the dollar against other currencies. Sometimes the changing price of certain commodities demonstrates inflation clearly and sometimes not due to the emerging markets of India and China.

Inflation is an insidious form of taxation of savings and fixed assets. Back in the 1970’s when inflation was less understood by the average investor, the Government would try to shift the blame for inflation, blaming “greedy” unions and “greedy” businesses, when the fact was that the U.S. Government was spending money it didn’t have. When the Fed is unable to mask the current inflation, expect the same tired, old excuses from Washington.

The inflation of the 1970’s is one reason the average investor does not put money into CD’s as in the past. America now saves through tax qualified retirement plans. A well invested retirement plan loses less value to inflation than investments outside of the plan. As long as tax rates don’t increase too much, it is more efficient from a taxpayer’s point of view to have the IRS take their bite at the end of the line when the money is disbursed than smaller bites along the way.

Roth accounts in which the contributions are not tax deductible but the growth is income tax free (if the rules are followed and if Congress doesn’t change the rules) can also help protect against inflation.

Electronic Filing of Form 5500

Our experience with electronic filing of Form 5500 in 2010 and 2011 has been good. The EBSA of the DOL has kept the program working smoothly. The fly in the ointment has been the IRS service center in Ogden Utah. All extensions to file Forms 5500, 5500-SF, and 5500-EZ must be filed with the Ogden Utah service center. We have had to prove over and over that extension forms were filed timely. Thank goodness we always use certified mail when sending anything to the Government that doesn’t have to be electronically filed. Still, it can take months to get the attention of a human being or, rather, one able and willing to fix the problem created by the IRS.

Form 5500-EZ Filings

The bad news is that Form 5500-EZ is filed with the Ogden Utah service center. I cannot stress strongly enough that these forms must be sent by certified mail as there is a real chance you must prove you filed them timely. Getting the penalties on late filings waived has become harder and harder even though I understand dogs still relish eating homework and tax forms.

Remember, you are responsible for filing Form 5500-EZ. You are responsible for providing us what we need to prepare it for you in a timely manner. We always try to follow-up, but we are not responsible if our letters are left unopened or the forms we send you are left unfiled.

Tax Legislation

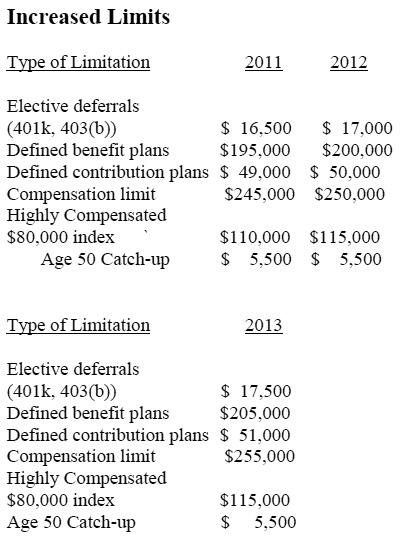

The truce in Congress on tax legislation is now over due to the election results. The reticence to do anything to hurt the 401(k) plans of registered voters might be a thing of the past. “Tax Reform” might very well include some reductions on the 401(k) deferral or other limits. To learn more, go to www.savemy401k.com

Please call me if you have any questions.